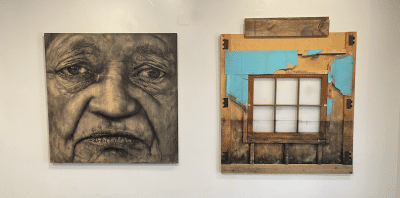

"Brownstone brownhome" by rutlo is licensed under CC BY-SA 2.0

The era of the ‘Covid apartment deal’ is over, and Brooklynites are feeling the squeeze

You're not imagining things: Rent prices have shot up around the borough

At 9:15 a.m. on a recent frigid Saturday, a well-dressed 20-something woman exited 660 Nostrand Avenue in Crown Heights onto the apartment building’s narrow raised stairs and gave real estate broker Suzanne Forrester a hearty goodbye wave.

Forrester, wearing a yellow sweater and blue surgical mask, looked a tad tired as she welcomed in the next prospective tenant, who was early for a 9:30 appointment. The woman who had just left was not the first person to view the apartment’s one available unit and far from the last. Forrester had only started showing the unit that morning and already had multiple people asking for applications for it.

“I’ve been up and down these stairs a lot today already,” she said as she ascended them again, leading the next viewer up a few flights. “I’m showing it all day today and that’s it, one and done.”

Forrester had been instantly and perpetually inundated with calls after posting the listing to Streeteasy a few days earlier. A brief search through that popular New York City listing site quickly reveals why: in comparison to other Crown Heights one-bedrooms, this one was a steal—at only $1650 per month, it boasted not only a relatively large kitchen and dining area, but an extra small office connected to the bedroom. Most other Crown Heights listings with less space were going for at least $2000.

Brooklynites are always quick to swarm a good deal, but the especially overheated interest in 660 Nostrand points to a larger trend: as the Omicron wave has passed, and broader fears about the Covid pandemic die down—all signs point to the virus becoming endemic, like the flu—people have flocked back to New York City. And far more of those people are looking to live throughout Brooklyn, as remote work has become an accepted norm and commute times into Manhattan become less relevant.

But there simply isn’t anywhere near to a sufficient supply to meet the demand, as has been the case for decades. Brooklyn Magazine reported last year that specifically from 2010 to 2020, the national census showed the borough added 78,300 housing units—while the population grew by 230,000.

This would create a squeeze in any set of circumstances, but after a year and a half of Covid-induced low occupancy rates and far-below-normal prices, the supply shortage now feels especially acute on the ground for Brooklynites. And the accompanying price spikes are akin to whiplash for buyers and especially renters, who are seeing their rents skyrocket as they instantly climb back to pre-Covid market levels on new leases.

The TL;DR version of this story? The era of the “Covid deal” is firmly over.

“In 2020, people left their small apartments they didn’t like and moved into bigger apartments at a deal,” says Statia Grossman, a broker with the Corcoran Group, one of the city’s largest residential real estate firms. “Only the little apartments left, and then those all got snatched up.”

Grossman, who works on more sales than rentals, said she’s feeling the same uptick in speed that Forrester is, even for apartments priced several hundred thousand dollars and up.

“A lot of places are having one weekend of open houses, and then that’s it,” she says.

Corcoran data shows the squeeze in plain terms—in just about every Brooklyn neighborhood the firm does business in, the percentage of leases signed from January 2021 to January 2022 dropped more than 30 percent. In some neighborhoods, such as Cobble Hill, Greenpoint and Bushwick, the percentage drop is twice that.

In turn, average rents in that period rose by 20 to 40 percent in most areas. The average rent in Greenpoint, for example, went from $2,969 to $4,080; in Prospect Heights it went from $2,694 to $3,992.

According to a study by the Corcoran Group, rents in Bed Stuy are up 10% since last year.

They’re up 22% in Fort Greene/Clinton Hill.

A whopping 48% in Prospect Heights.Brooklyn, this is unsustainable. Good Cause Eviction would limit rental increases to 3% or 1.5x the CPI. pic.twitter.com/Gn5vTL3c06

— Jabari Brisport🌹 (@JabariBrisport) February 19, 2022

Tucker Reed, who heads the Totem development group, says the numbers are simply going back to the previous trajectory they were on before the pandemic. They just look wild on paper because of the Covid blip.

“There hasn’t been a kind of external shock like Covid to the housing market in more than a decade,” Reed says. “I don’t think of it as some like huge bubble, or some weird phenomenon. It’s just there was a dip in demand for a year or two, and so people got deals during that time period that stuck around. And now we’re back to the way it was like before the pandemic—the whole world wants to come to New York.”

That fact wasn’t comforting to the dozen or so people lined up in the hallway outside of 635 Grand Avenue, unit #10, in Prospect Heights on the same recent Saturday. After someone broke the awkward silence, a chummy conversation started as most revealed they were reeling from the same phenomenon—rent hikes upwards of $600 and $700 per month. The agent showing the apartment was also charging an unusually high broker’s fee: 12 percent of a year’s rent. Since the unit was going for $1,950 per month (another steal given its size and location) that amounts to a $2,808 check. Some in the line had encountered that elsewhere, too.

“It’s actually comforting coming to one of these, and seeing all of these people [going through the same thing]!” said one 20-something woman there with her boyfriend who declined to be identified.

Things don’t have to be this way. Reed says New York suffers from a mix of local government bureaucracy that slows down the issuing of building permits and overly powerful landlords who want to keep supply low so prices can stay high. He points to a different city that adds a sufficient amount of housing permits to match demand: Tokyo.

New York Times writer Hiroki Tabuchi tweeted earlier this month how that trend keeps Tokyo real estate prices much more reasonable. Not that the city’s geographic location on the opposite side of the world will offer much comfort to Brooklynites.

Because people still won’t believe me when I say Tokyo rents are infinitely more affordable than NYC: this light-filled, modern apartment is 15 mins by train from Shibuya, and is going for approx $1,250 a month. https://t.co/K4sDBbHW4r pic.twitter.com/Zhc5Mss4i5

— Hiroko Tabuchi (@HirokoTabuchi) February 8, 2022

Grossman had a word of advice for hunters who have the luxury of timing: wait until spring or fall to find a new place, because those seasons bring more openings, which could slightly relax the craze. But it’s never easy.

“There will be more inventory,” she said, “but that means there’s a whole lot of people whose leases are coming up. So it’s going be a lot of people looking.”

You might also like